import pandas as pd

import numpy as np

import seaborn as sns

import matplotlib.pyplot as plt

from sklearn.linear_model import Ridge, RidgeCV, Lasso, LassoCV, LogisticRegressionCV, LogisticRegression

from sklearn.preprocessing import StandardScaler

from sklearn.metrics import r2_score, accuracy_score

from sklearn.model_selection import cross_val_score, cross_val_predict5 Ridge regression and Lasso

Read section 6.2 of the book before using these notes.

Note that in this course, lecture notes are not sufficient, you must read the book for better understanding. Lecture notes are just implementing the concepts of the book on a dataset, but not explaining the concepts elaborately.

trainf = pd.read_csv('./Datasets/house_feature_train.csv')

trainp = pd.read_csv('./Datasets/house_price_train.csv')

testf = pd.read_csv('./Datasets/house_feature_test.csv')

testp = pd.read_csv('./Datasets/house_price_test.csv')

train = pd.merge(trainf,trainp)

test = pd.merge(testf,testp)

train.head()| house_id | house_age | distance_MRT | number_convenience_stores | latitude | longitude | house_price | |

|---|---|---|---|---|---|---|---|

| 0 | 210 | 5.2 | 390.5684 | 5 | 24.97937 | 121.54245 | 2724.84 |

| 1 | 190 | 35.3 | 616.5735 | 8 | 24.97945 | 121.53642 | 1789.29 |

| 2 | 328 | 15.9 | 1497.7130 | 3 | 24.97003 | 121.51696 | 556.96 |

| 3 | 5 | 7.1 | 2175.0300 | 3 | 24.96305 | 121.51254 | 1030.41 |

| 4 | 412 | 8.1 | 104.8101 | 5 | 24.96674 | 121.54067 | 2756.25 |

5.1 Ridge regression

Let us develop a ridge regression model to predict house price based on the five house features.

#Taking the log transform of house_price as house prices have a right-skewed distribution

y = np.log(train.house_price)5.1.1 Standardizing the predictors

#Standardizing predictors so that each of them have zero mean and unit variance

#Filtering all predictors

X = train.iloc[:,1:6];

#Defining a scaler object

scaler = StandardScaler()

#The scaler object will contain the mean and variance of each column (predictor) of X.

#These values will be useful to scale test data based on the same mean and variance as obtained on train data

scaler.fit(X)

#Using the scaler object (or the values of mean and variance stored in it) to standardize X (or train data)

Xstd = scaler.transform(X)5.1.2 Optimizing the tuning parameter λ

#The tuning parameter lambda is referred as alpha in sklearn

#Creating a range of values of the tuning parameter to visualize the ridge regression coefficients

#for different values of the tuning parameter

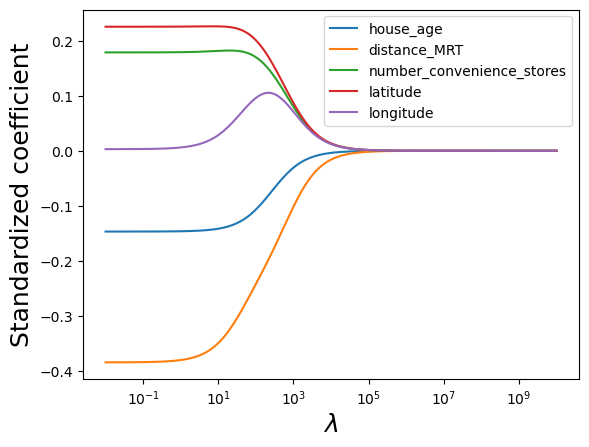

alphas = np.logspace(10,-2,200)#Finding the ridge regression coefficients for increasing values of the tuning parameter

coefs = []

for a in alphas:

ridge = Ridge(alpha = a)

ridge.fit(Xstd, y)

coefs.append(ridge.coef_)#Visualizing the shrinkage in ridge regression coefficients with increasing values of the tuning parameter lambda

plt.xlabel('xlabel', fontsize=18)

plt.ylabel('ylabel', fontsize=18)

plt.plot(alphas, coefs)

plt.xscale('log')

plt.xlabel('$\lambda$')

plt.ylabel('Standardized coefficient')

plt.legend(train.columns[1:6]);

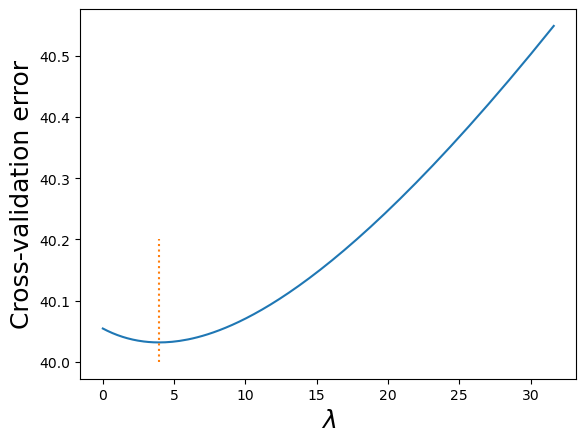

#Let us use cross validation to find the optimal value of the tuning parameter - lambda

#For the optimal lambda, the cross validation error will be the least

#Note that we are reducing the range of alpha so as to better visualize the minimum

alphas = np.logspace(1.5,-3,200)

ridgecv = RidgeCV(alphas = alphas,store_cv_values=True)

ridgecv.fit(Xstd, y)

#Optimal value of the tuning parameter - lambda

ridgecv.alpha_3.939829130085526#Visualizing the LOOCV (leave one out cross validatation error vs lambda)

plt.xlabel('xlabel', fontsize=18)

plt.ylabel('ylabel', fontsize=18)

plt.plot(ridgecv.alphas,ridgecv.cv_values_.sum(axis=0))

plt.plot([ridgecv.alpha_,ridgecv.alpha_],[40,40.2],':')

plt.xlabel('$\lambda$')

plt.ylabel('Cross-validation error');

Note that the cross validation error is minimum at the optimal value of the tuning parameter.

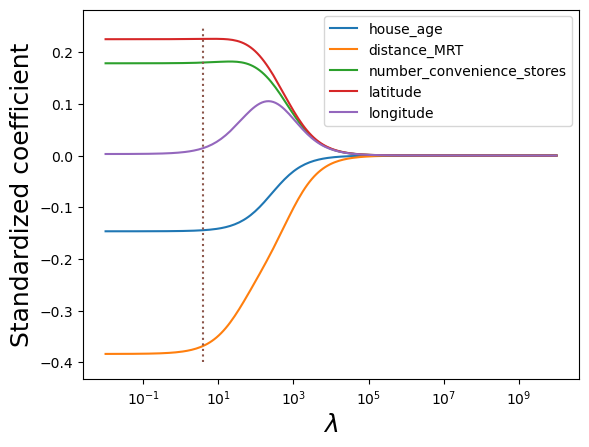

#Visualizing the shrinkage in ridge regression coefficients with increasing values of the tuning parameter lambda

alphas = np.logspace(10,-2,200)

plt.xlabel('xlabel', fontsize=18)

plt.ylabel('ylabel', fontsize=18)

plt.plot(alphas, coefs)

plt.plot([ridgecv.alpha_,ridgecv.alpha_],[-0.4,0.25],':')

plt.xscale('log')

plt.xlabel('$\lambda$')

plt.ylabel('Standardized coefficient')

plt.legend(train.columns[1:6]);

5.1.3 RMSE on test data

#Test dataset

Xtest = test.iloc[:,1:6]

#Standardizing test data

Xtest_std = scaler.transform(Xtest)#Using the developed ridge regression model to predict on test data

ridge = Ridge(alpha = ridgecv.alpha_)

ridge.fit(Xstd, y)

pred=ridge.predict(Xtest_std)#RMSE on test data

np.sqrt(((np.exp(pred)-test.house_price)**2).mean())405.64878431933295Note that the RMSE is similar to the one obtained using least squares regression on all the five predictors. This is because the coefficients were required to shrink very slightly for the best ridge regression fit. This may happen when we have a low number of predictors, where most of them are significant. Ridge regression is likely to perform better than least squares in case of a large number of predictors, where an OLS model will be prone to overfitting.

5.1.4 Model coefficients & \(R\)-squared

#Checking the coefficients of the ridge regression model

ridge.coef_array([-0.14444475, -0.3683359 , 0.17988341, 0.22567002, 0.01429926])Note that none of the coefficients are shrunk to zero. The coefficient of longitude is smaller than the rest, but not zero.

#R-squared on train data for the ridge regression model

r2_score(ridge.predict(Xstd),y)0.6993726041206049#R-squared on test data for the ridge regression model

r2_score(pred,np.log(test.house_price))0.7572762313360965.2 Lasso

Let us develop a lasso model to predict house price based on the five house features.

5.2.1 Standardizing the predictors

We have already standardized the predictors in the previous section. The standardized predictors are the NumPy array object Xstd.

5.2.2 Optimizing the tuning parameter λ

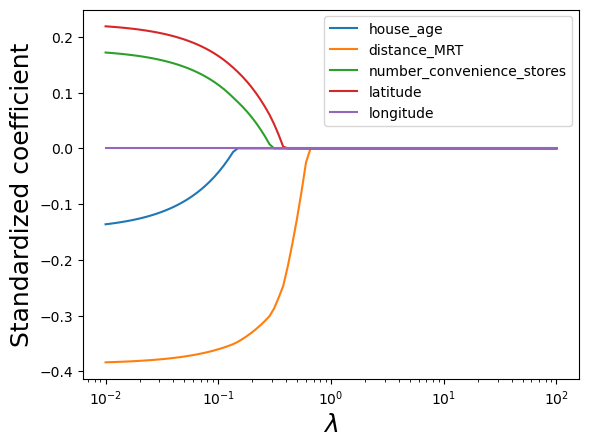

#Creating a range of values of the tuning parameter to visualize the lasso coefficients

#for different values of the tuning parameter

alphas = np.logspace(2,-2,100)#Finding the lasso coefficients for increasing values of the tuning parameter

lasso = Lasso(max_iter = 10000)

coefs = []

for a in alphas:

lasso.set_params(alpha=a)

lasso.fit(Xstd, y)

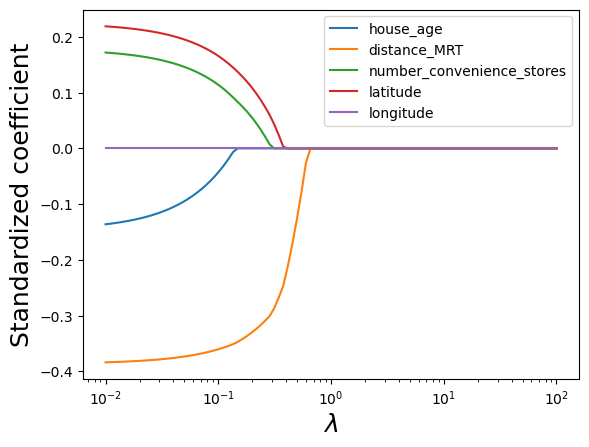

coefs.append(lasso.coef_)#Visualizing the shrinkage in lasso coefficients with increasing values of the tuning parameter lambda

plt.xlabel('xlabel', fontsize=18)

plt.ylabel('ylabel', fontsize=18)

plt.plot(alphas, coefs)

plt.xscale('log')

plt.xlabel('$\lambda$')

plt.ylabel('Standardized coefficient')

plt.legend(train.columns[1:6]);

Note that lasso performs variable selection. For certain values of lambda, some of the predictor coefficients are zero, while others are non-zero. This is different than ridge regression, which only shrinks the coefficients, but doesn’t do variable selection.

#Let us use cross validation to find the optimal value of the tuning parameter - lambda

#For the optimal lambda, the cross validation error will be the least

#Note that we are reducing the range of alpha so as to better visualize the minimum

alphas = np.logspace(-1.5,-5,200)

lassocv = LassoCV(alphas = alphas, cv = 10, max_iter = 100000)

lassocv.fit(Xstd, y)

#Optimal value of the tuning parameter - lamda

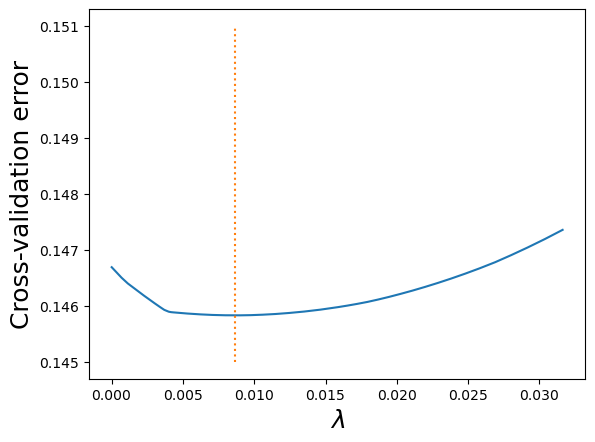

lassocv.alpha_0.00865338307114046#Visualizing the LOOCV (leave one out cross validatation error vs lambda)

plt.xlabel('xlabel', fontsize=18)

plt.ylabel('ylabel', fontsize=18)

plt.plot(lassocv.alphas_,lassocv.mse_path_.mean(axis=1))

plt.plot([lassocv.alpha_,lassocv.alpha_],[0.145,0.151],':')

plt.xlabel('$\lambda$')

plt.ylabel('Cross-validation error');

The 10-fold cross validation error minimizes at lambda = 0.009.

#Visualizing the shrinkage in lasso coefficients with increasing values of the tuning parameter lambda

alphas = np.logspace(2,-2,100)

plt.xlabel('xlabel', fontsize=18)

plt.ylabel('ylabel', fontsize=18)

plt.plot(alphas, coefs)

plt.xscale('log')

plt.xlabel('$\lambda$')

plt.ylabel('Standardized coefficient')

plt.legend(train.columns[1:6]);

5.2.3 RMSE on test data

#Using the developed lasso model to predict on test data

lasso = Lasso(alpha = lassocv.alpha_)

lasso.fit(Xstd, y)

pred=lasso.predict(Xtest_std)#RMSE on test data

np.sqrt(((np.exp(pred)-test.house_price)**2).mean())400.85801088048185.2.4 Model coefficients & \(R\)-squared

#Checking the coefficients of the lasso model

lasso.coef_array([-0.13758288, -0.38414914, 0.17276584, 0.21970825, 0. ])Note that the coefficient of longitude is shrunk to zero. Lasso performs variable selection.

#R-squared on train data for the lasso model

r2_score(lasso.predict(Xstd),y)0.6931007715680897#R-squared on test data for the lasso model

r2_score(pred,np.log(test.house_price))0.75269686602836555.3 Lasso/Ridge Classification

The Ridge and Lasso penalties are added from inside the same LogisticRegression object, they don’t have their own objects like they do in regression.

# Data

train = pd.read_csv('Datasets/Social_Network_Ads_train.csv')

test = pd.read_csv('Datasets/Social_Network_Ads_test.csv')# Predictors and response

X_train = train[['Age', 'EstimatedSalary']]

y_train = train['Purchased']

X_test = test[['Age', 'EstimatedSalary']]

y_test = test['Purchased']# Creating the model

# penalty=None means regular logistic Regression

# penalty=l2 means Ridge Classification

# penalty=l1 means Lasso Classification

# C = 1/lambda

model = LogisticRegression(penalty='l2', C = 1)# Scale

sc = StandardScaler()

sc.fit(X_train)

X_train_scaled = sc.transform(X_train)

X_test_scaled = sc.transform(X_test)

# Train

model.fit(X_train_scaled, y_train)

y_pred = model.predict(X_test_scaled) # threshold = 0.5 here

# Evaluate

print(accuracy_score(test.Purchased, y_pred)*100)

# Probs

y_pred_probs = model.predict_proba(X_test_scaled)88.05.3.1 Cross-validation to find optimal C

# a list of possible C values

Cs = np.logspace(-1,1)

# Cs = the C values we want to try out

# cv = number of folds, 3,5,10 - if no input given, 5-fold

# penalty = Ridge or Lasso

model_cv = LogisticRegressionCV(Cs = Cs, cv=5, penalty='l2')

model_cv.fit(X_train_scaled, y_train)

model_cv.C_[0]1.3894954943731375model = LogisticRegression(penalty='l2', C = model_cv.C_[0])

model.fit(X_train_scaled, y_train)

y_pred = model.predict(X_test_scaled) # threshold = 0.5 here

# Evaluate

print(accuracy_score(test.Purchased, y_pred)*100)88.0